Set Your Organizations Tax Ruleset | Self Serve

Tax Ruleset | Self Serve

In the past, Admins faced challenges when updating tax values, as any changes would affect existing invoices retroactively. This limitation arose because there was only one tax value per location across the entire invoicing history.

WHAT’S NEW!

Great news! Admins can now manage Tax Ruleset section in Mission Control for your organization. Here’s how you can set and update tax rule sets:

- Adding a Tax Ruleset:

In MC, the Tax Rule Set section can be enabled for your organization through configuration. This allows you to update the latest tax rule set easily.

- Updating Tax Rule Sets:

When you click on a specific Tax Rule Set, you’ll see the latest version. You can update this version, ensuring you’re always working with the most recent rules.

- Accessing Previous Versions:

You can view previous versions of a Tax Rule Set in a widget on the detail screen. This includes details like the name of the rule set, start and end dates. Clicking on a specific row takes you to that version’s detail screen, though updates are only available for the latest version.

- Applying Tax Types to SKUs:

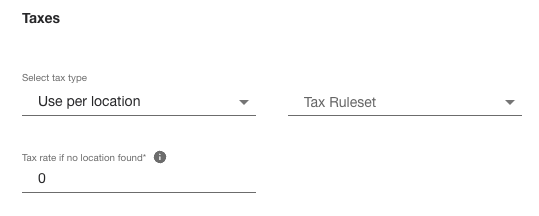

When editing or creating a new SKU in the SKU section, choosing "Per location" in the Tax type dropdown lets you set a mandatory tax rate if no location is specified in the Tax Rule Set.

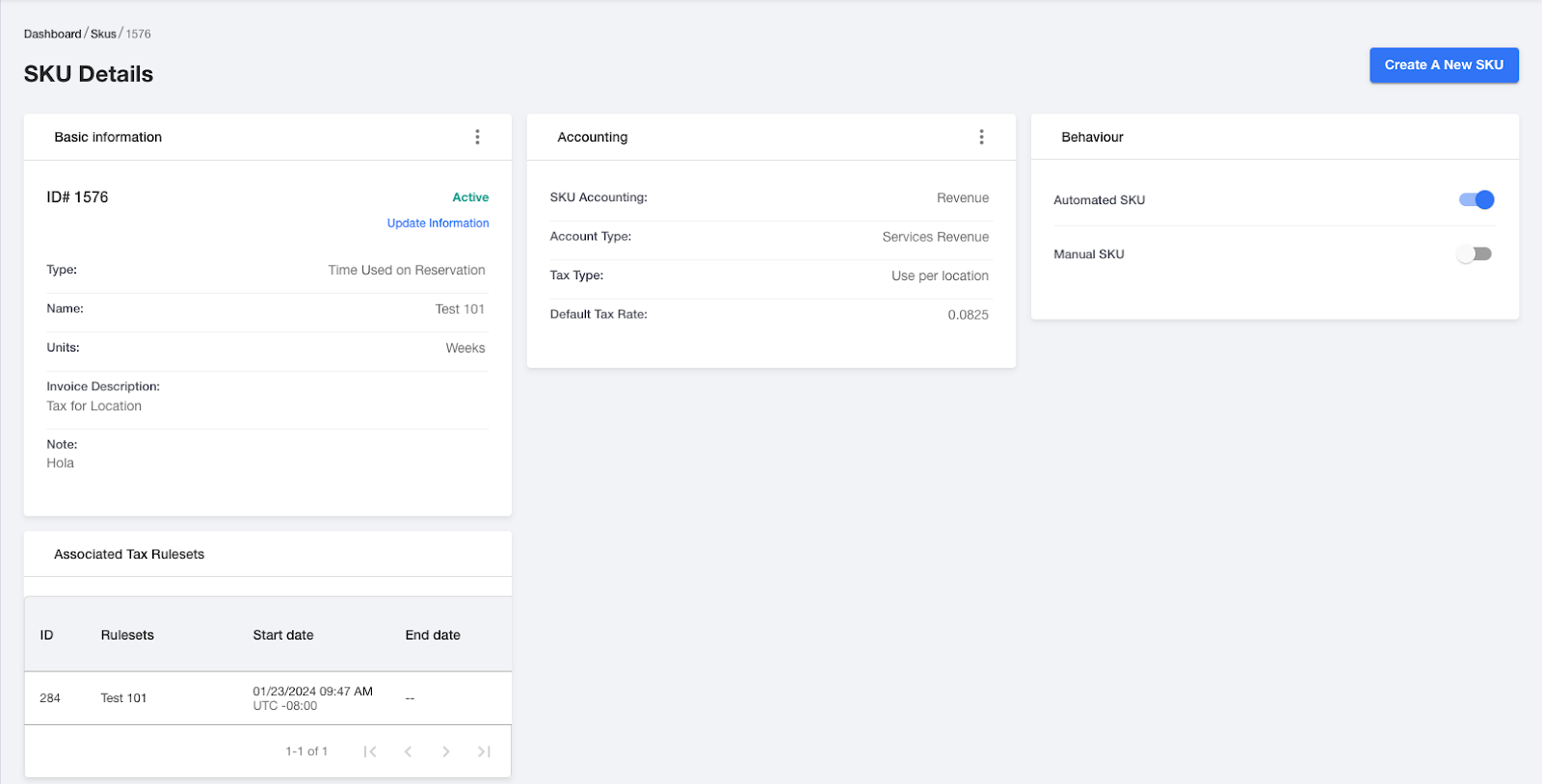

- Tracking Tax Rule Sets for SKUs:

You can easily see which rule sets were applied to a SKU in the past through a widget in the SKU detail screen. Details include the rule set name, start and end dates. Clicking on a specific row takes you to that rule set’s detail screen.

Managing tax rules is made simple within MC, ensuring accurate and up-to-date tax management for your organization's needs.

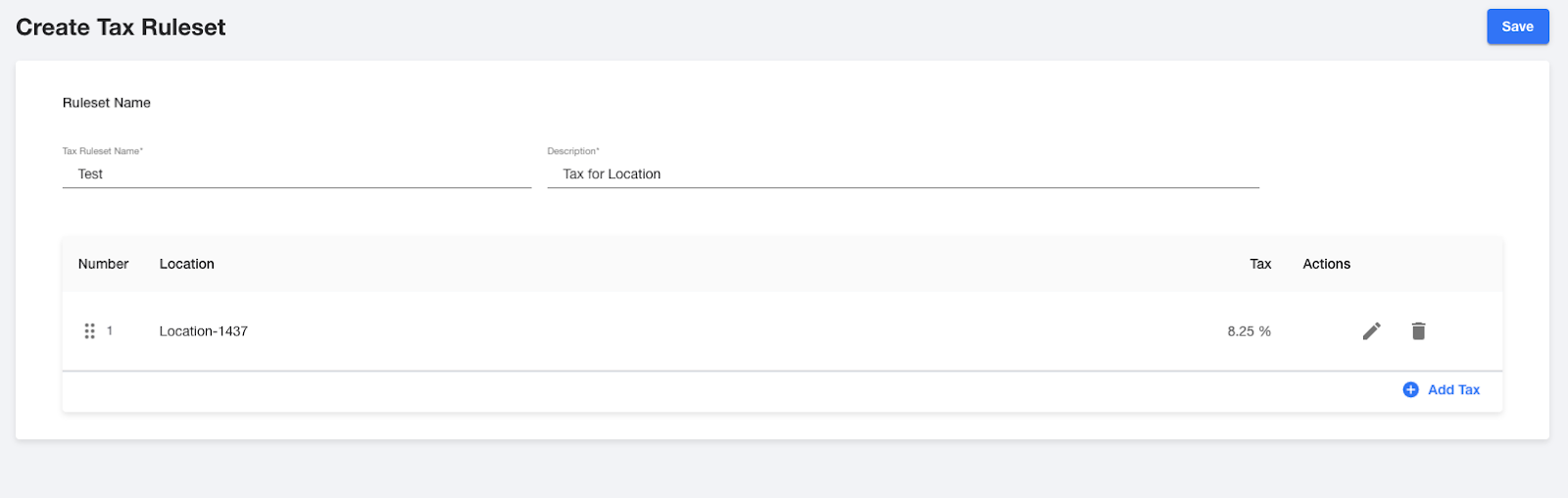

How to Add a Tax Ruleset:Here are the steps to add the Tax Ruleset:

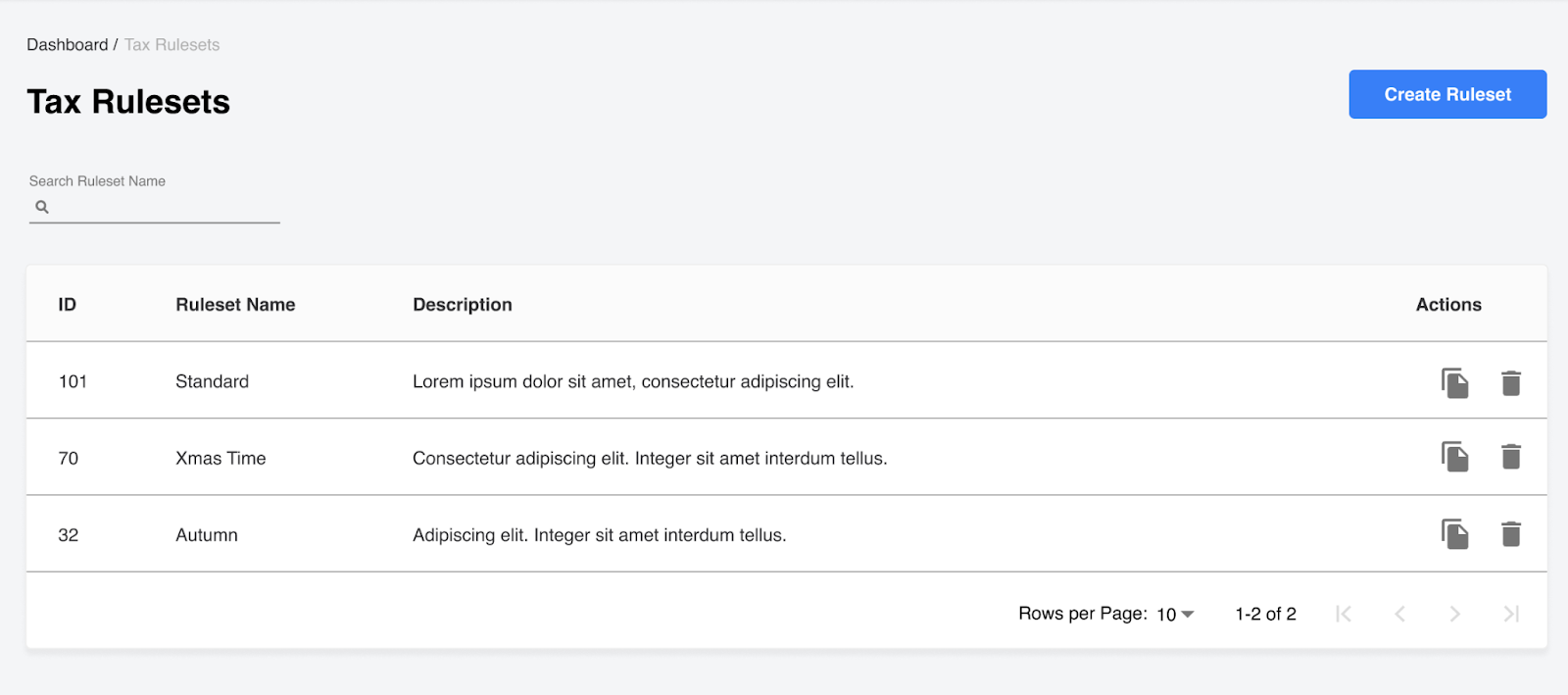

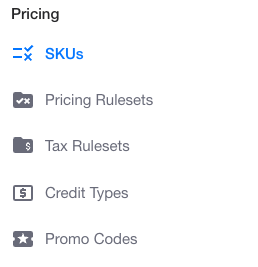

Dashboard → Pricing Section → Tax Rulesets

Click on Tax Rulesets → click on Create Ruleset button

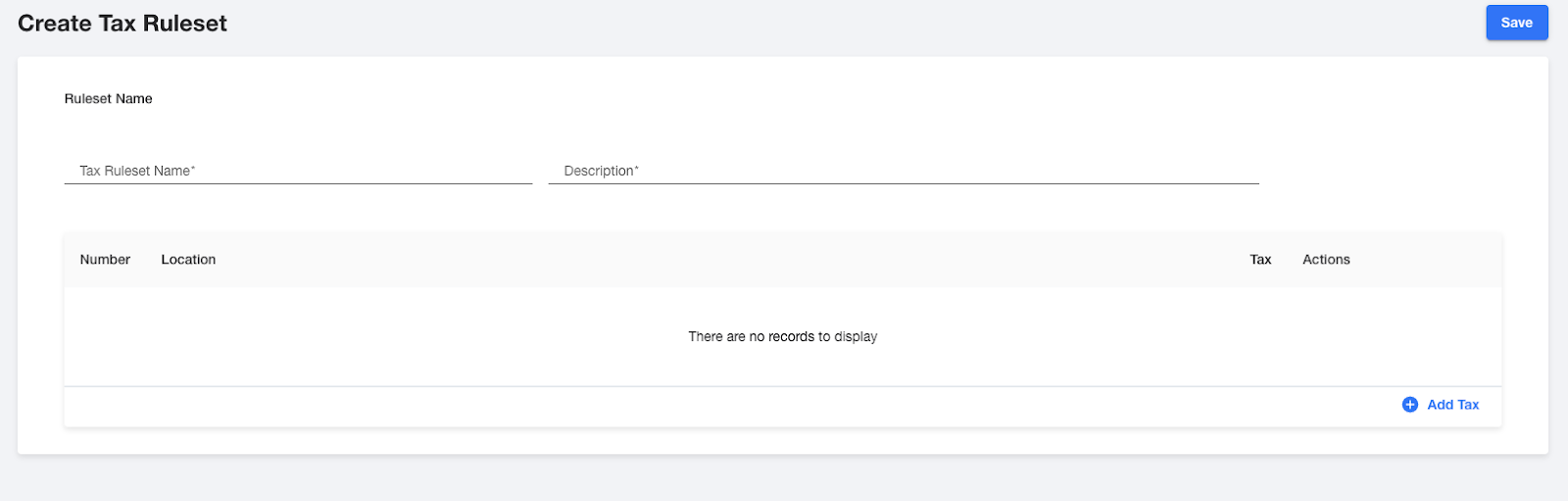

Enter the following Information:

Tax Ruleset Name - For example it can be the location, the city or however you would like to identify the Tax Ruleset

Description - What will this tax ruleset be used for or whatever description you’d prefer

Once you have added Tax Ruleset Name and Description press the Add Tax button on the bottom right.

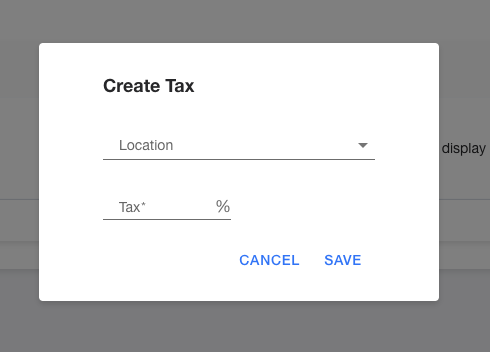

Create Tax Box will appear:

- Add the location it is associated with

- Add the Tax Value

Then click SAVE

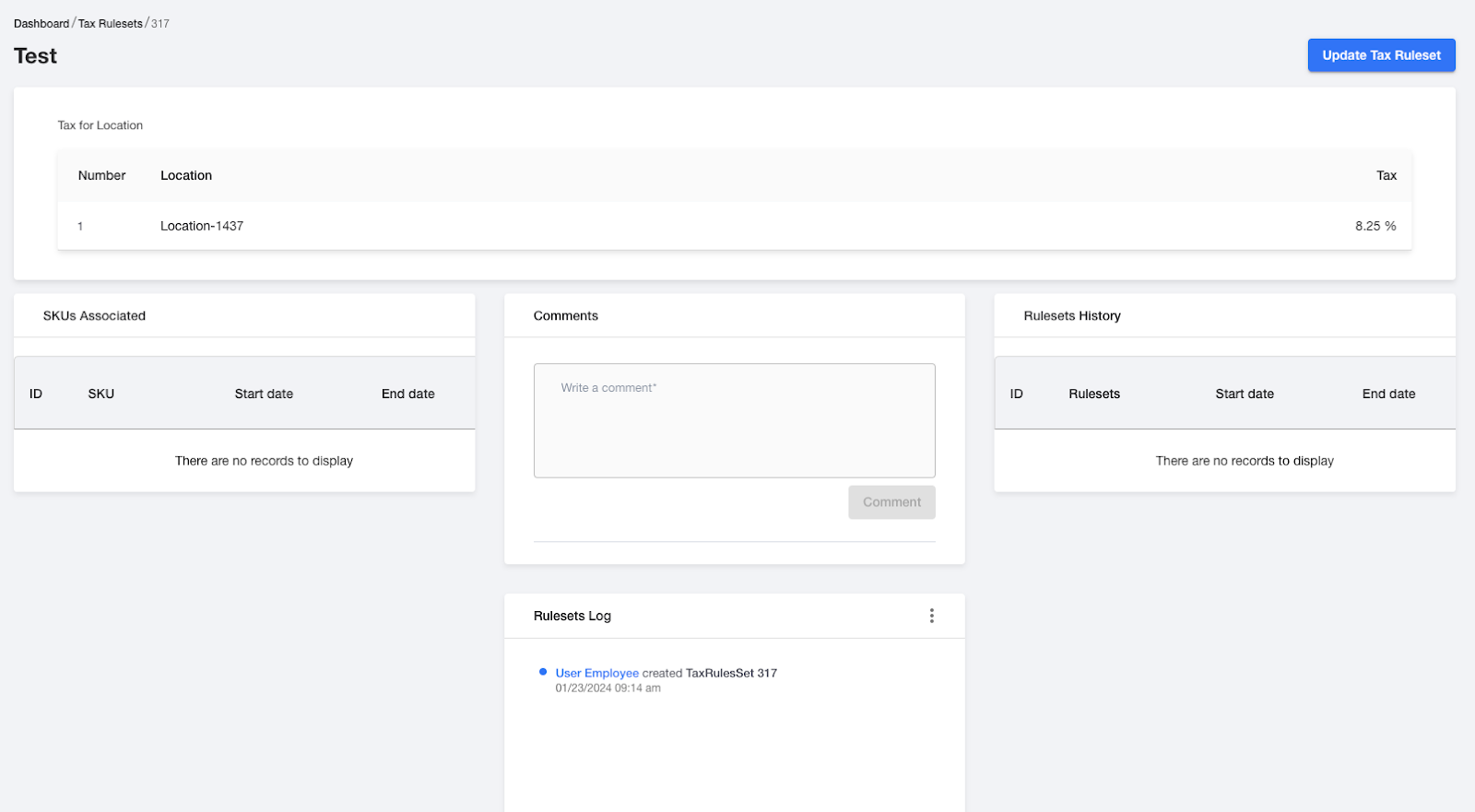

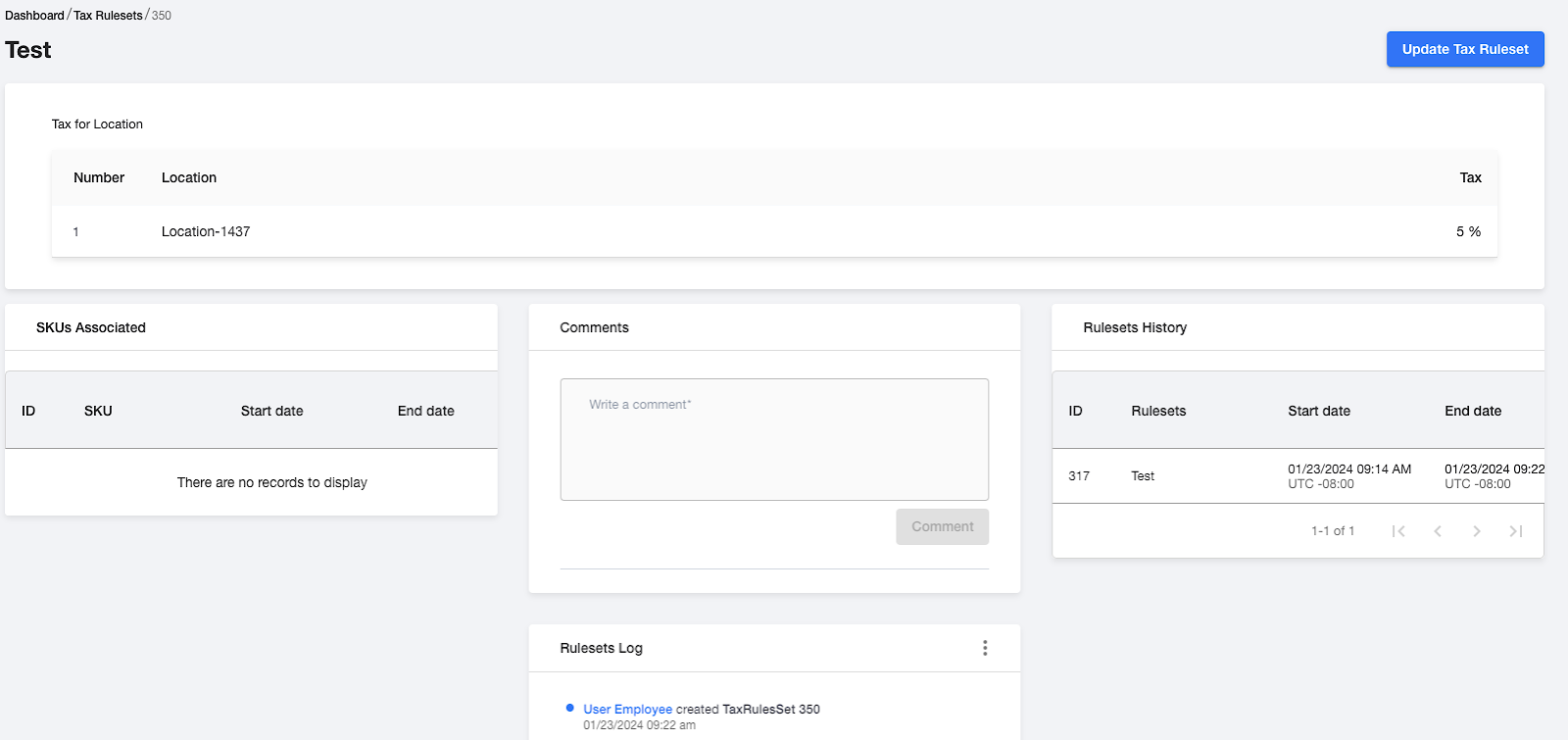

Notice the screen shows the following information:

- Tax for location

- The tax%Tthe SKU’s Associated,

- Ruleset Log

- Ruleset History

Congratulations, you have successfully created your Tax Ruleset!

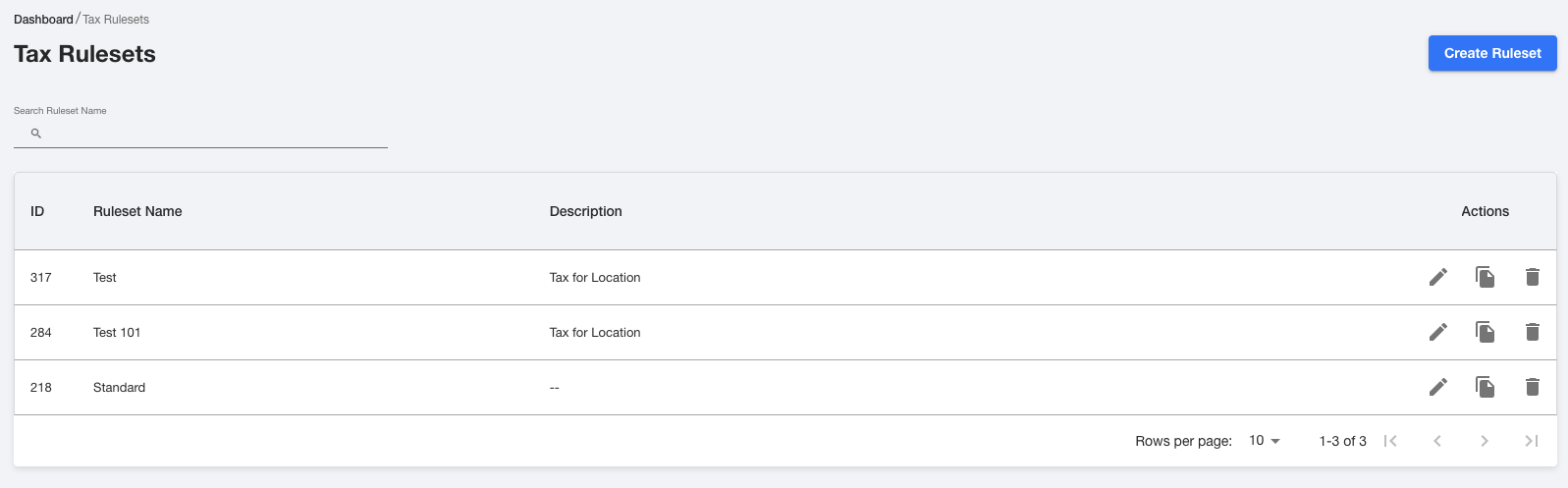

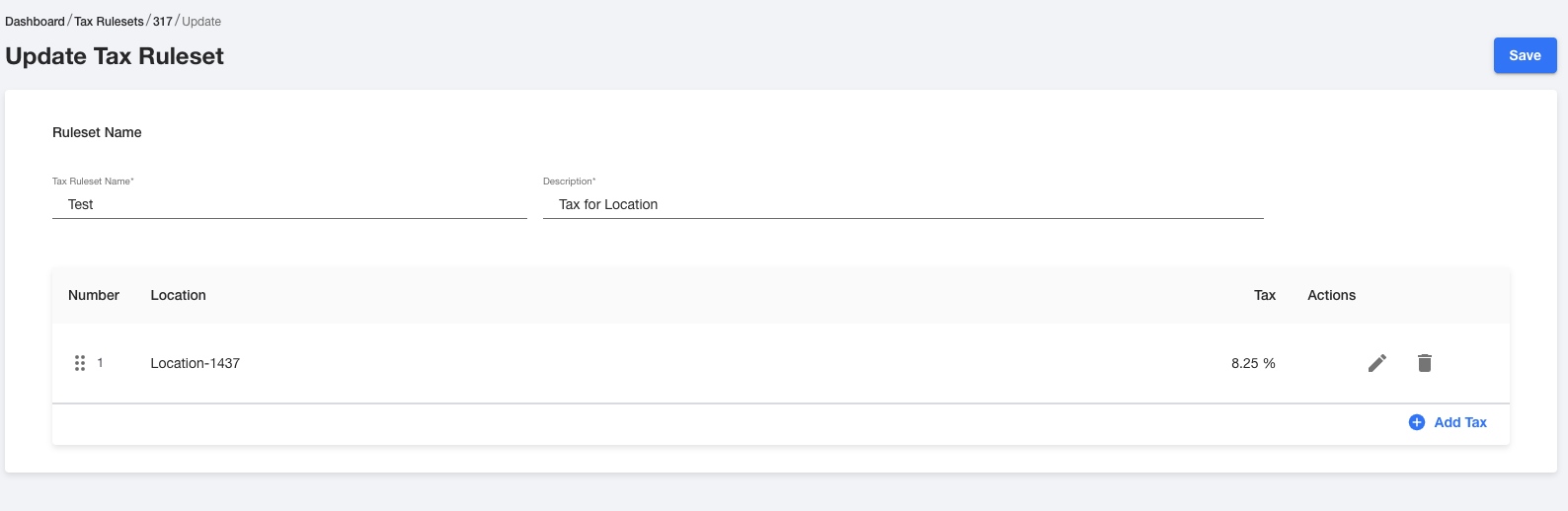

How do you update your Tax Ruleset:Go to Tax Rulesets → Find the Ruleset Name you want to edit → click on pencil icon

It will take you to this page:

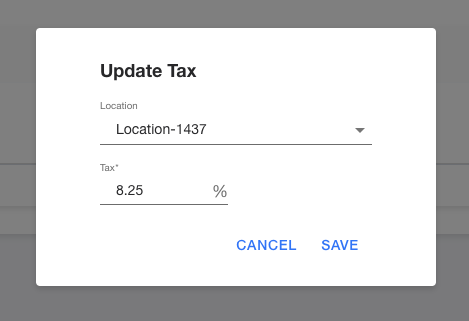

Click on pencil icon and the Update Tax Pop Up will appear:

You can change % of tax here and/or change the location then click SAVE

Congratulations, you have successfully UPDATED your TAX RULESET!

How do you ACCESS RULESET HISTORY?

You can view previous versions of a Tax Rule Set in a widget on the detail screen. This includes details like the name of the rule set, start and end dates. Clicking on a specific row takes you to that version’s detail screen, though updates are only available for the latest version.

Ruleset History will be available for each Ruleset name you search. Click on the Ruleset and the details will be available for your viewing.

Note: All Rulesets will be honored based on when they were used. The History will show you Start and End Date.

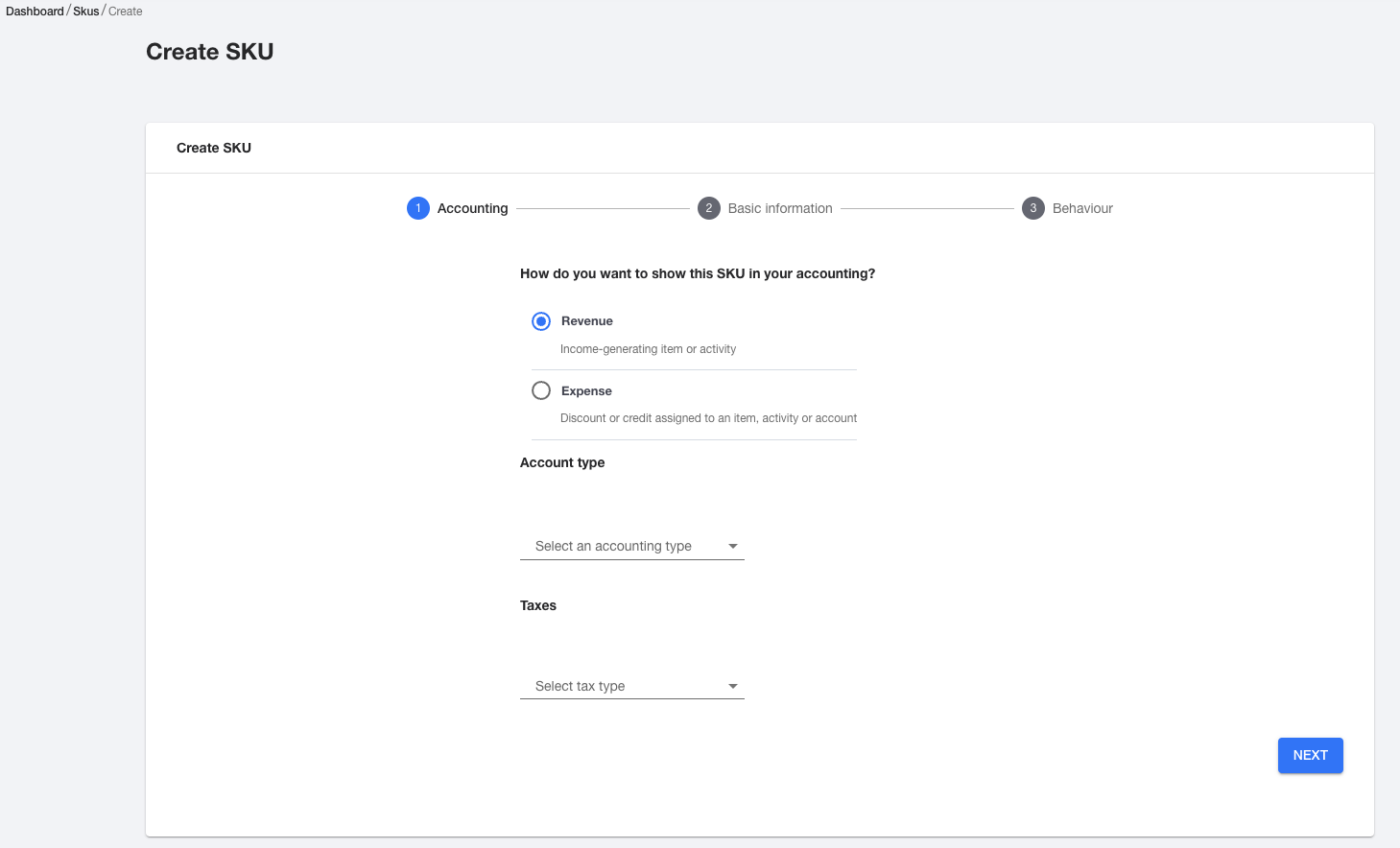

Applying Tax Types to SKUs:How to Create SKU and add Tax Ruleset

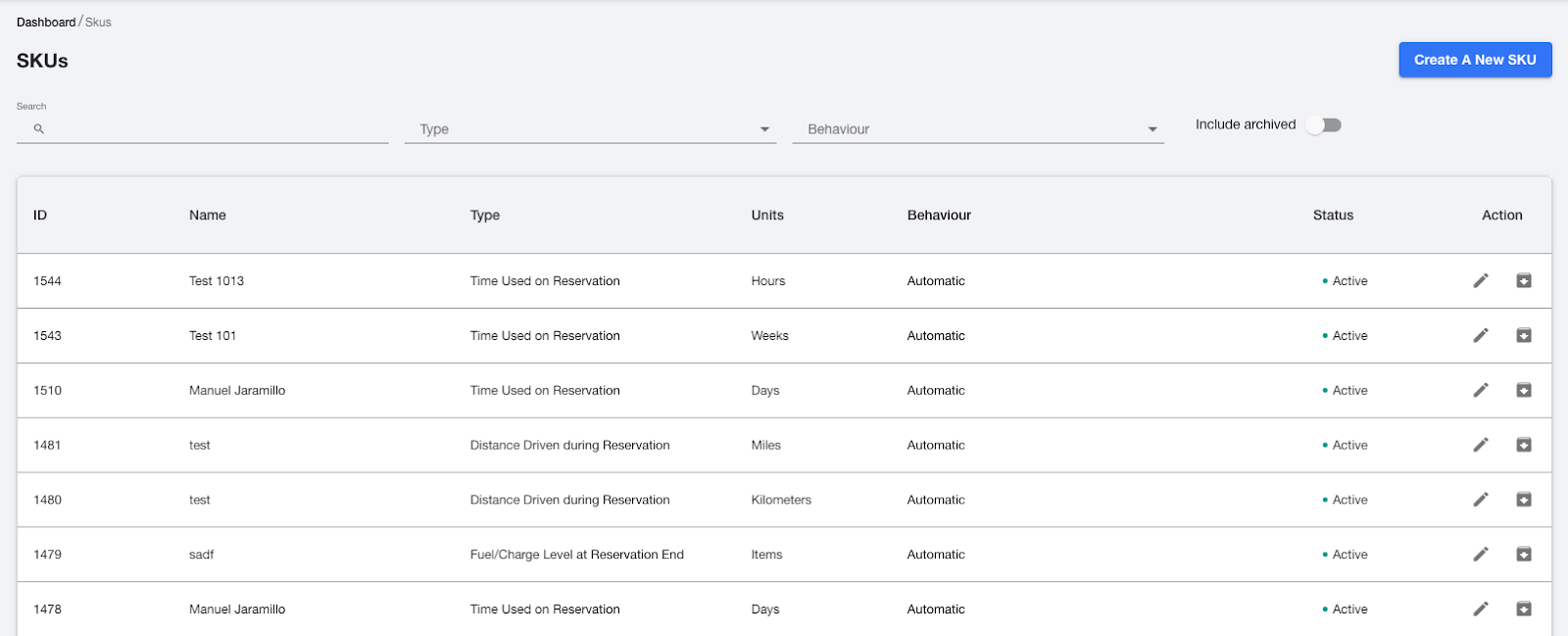

Go to Dashboard Section → Under Pricing → Click on SKU’s

You can Create a New SKU or Update an Existing SKU

Create SKU and add Tax Ruleset

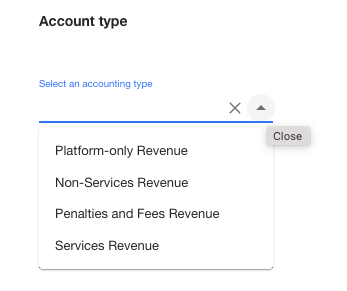

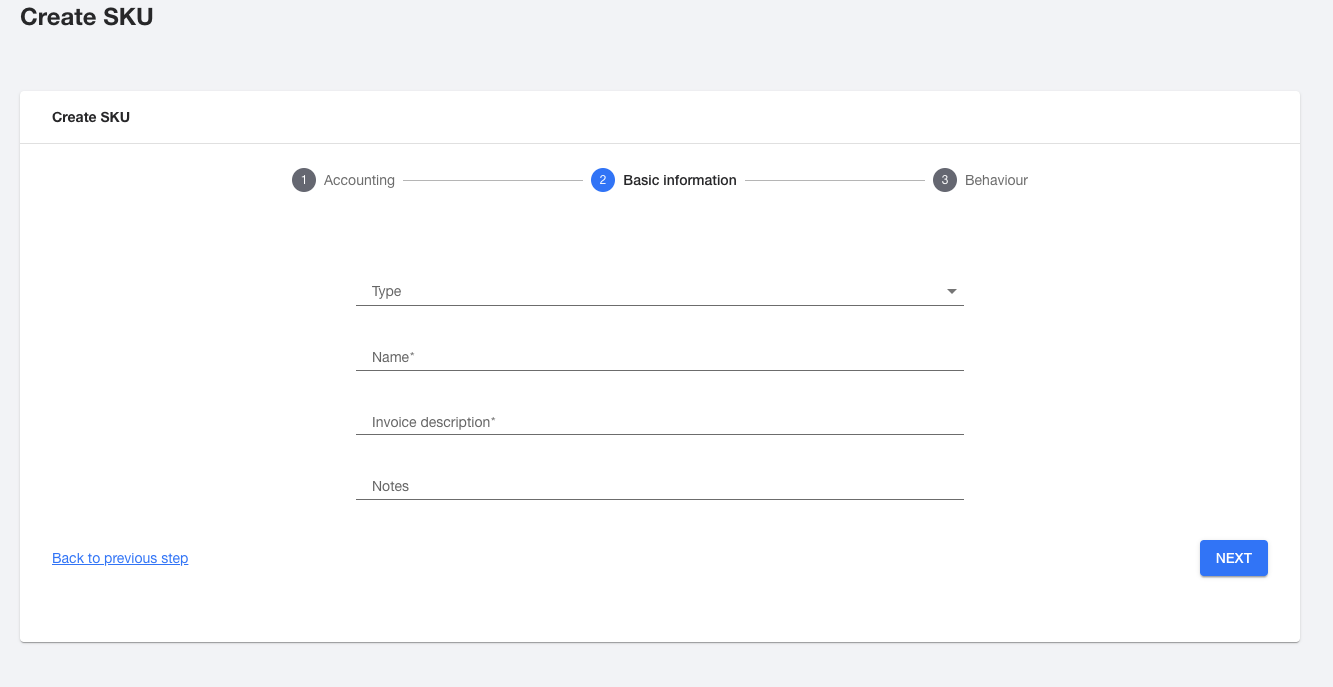

Click on Create SKU → Choose Revenue → Add Accounting Type i.e. Service Revene

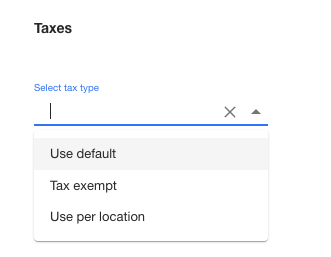

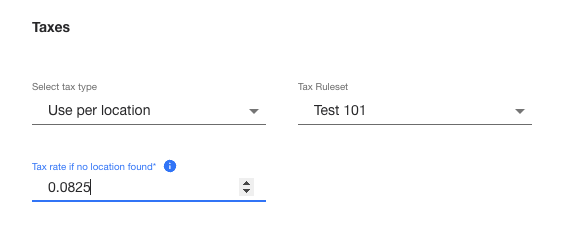

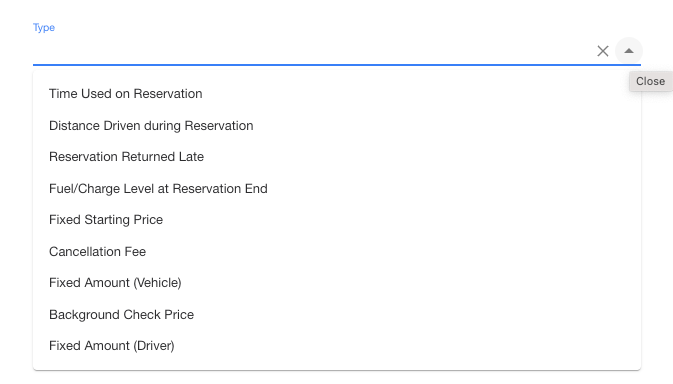

Select the tax type: You can select from the following three

Select Use Per Location to set Tax for location → Add Tax Ruleset and Tax Rate (in decimals)

Follow the following steps:

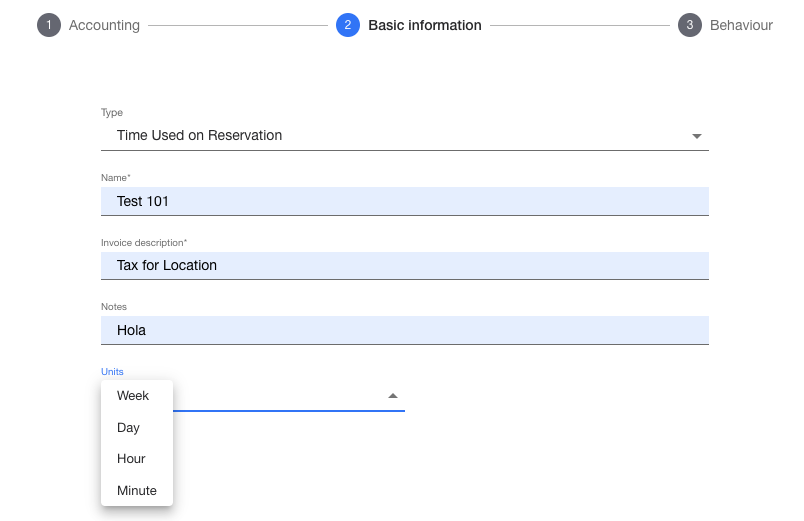

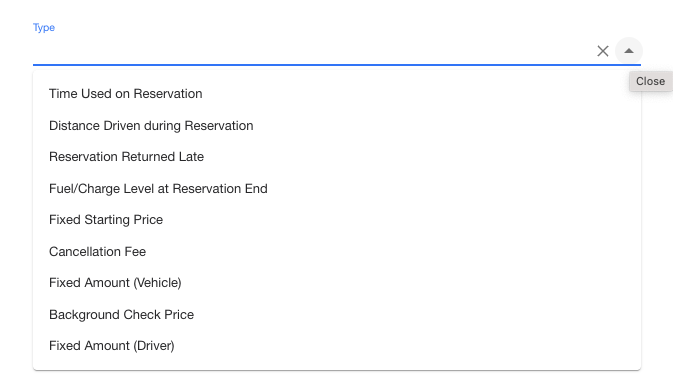

Fill out Basic Information

Once Basic Information is complete, next step will be:

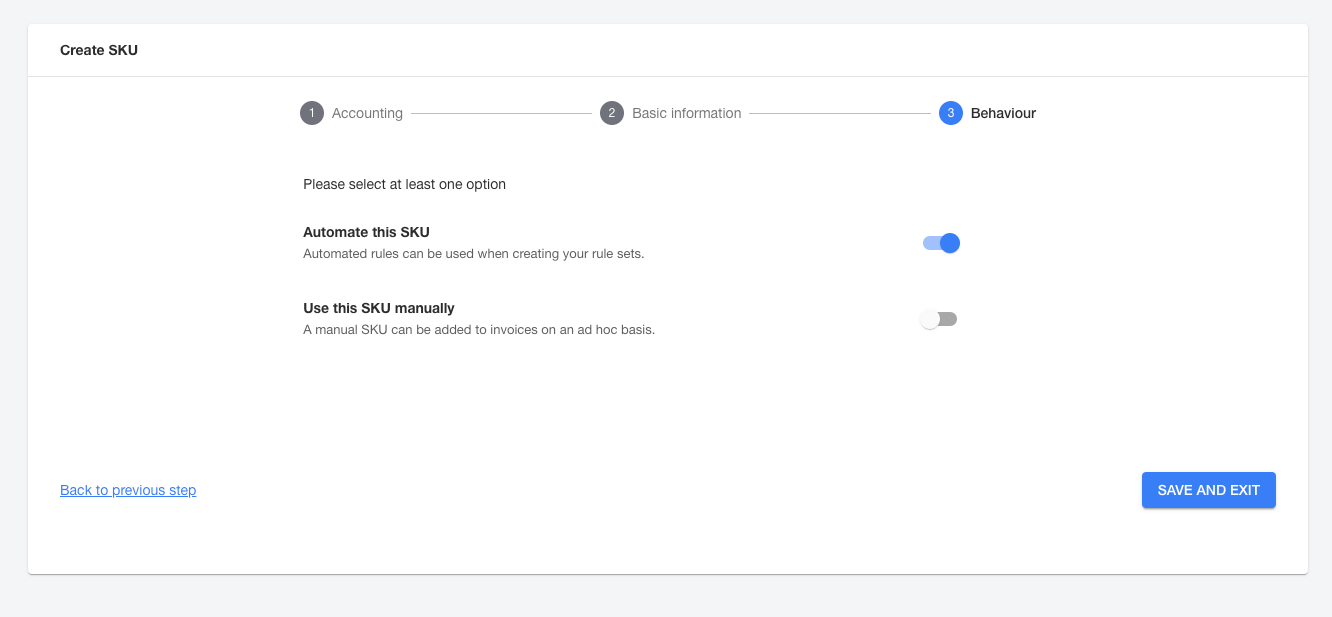

Add Behaviour:

- Automate the SKU

- Use the SKU Manually

Then Save and Exit

Congratulations, you have successfully created and added a tax ruleset to a SKU.

If you should have any questions, please feel free to reach out to our CX Team at operations@launchmobilty.com

Thank you!

-1.png?width=200&height=51&name=LM_NuBlu_Horiz_Hi%20(1)-1.png)